Nike is entangled in a $5 million class-action lawsuit following the abrupt closure of its NFT division, RTFKT, in January 2025. Filed in Brooklyn federal court, the suit claims that investors suffered significant losses due to the plummeting value of Nike-branded NFTs, with some collections dropping over 80%. The plaintiffs argue that Nike violated consumer protection laws in New York, California, Florida, and Oregon, alleging the NFTs were marketed as unregistered securities and that the shutdown constituted a “rug pull.”

Background of the Controversy

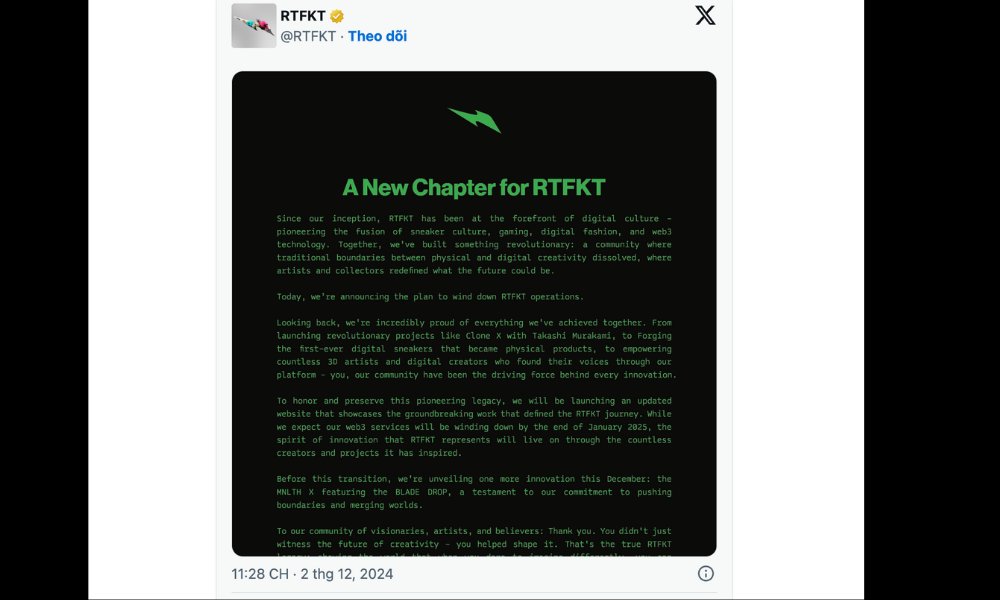

Nike acquired RTFKT Studios in December 2021 for an undisclosed sum, aiming to capitalize on the NFT and metaverse boom. RTFKT, founded in 2020, was renowned for its digital sneakers and collectibles, generating nearly $50 million in revenue, including $45 million in royalties, per DefiLlama data. Its flagship collections, like CloneX and MNLTH, were highly successful, with CloneX alone driving $1.5 billion in trading volume. However, as the metaverse hype faded and Nike forecasted declining sneaker demand in June 2024, RTFKT announced its closure, citing a strategic pivot despite launching a final “BLADE DROP” collection.

The shutdown triggered a sharp decline in NFT values. CloneX’s floor price fell 65% to below 0.3 ETH, though it later recovered slightly to 0.345 ETH. Investors, who had spent thousands on NFTs like the RTFKT x Nike Dunk Genesis CryptoKicks (once valued at over $14,800 on OpenSea), were left reeling. The lawsuit, backed by Rosen Law Firm, accuses Nike of misleading marketing and failing to disclose risks, claiming the company abandoned RTFKT without compensating holders.

Legal and Market Implications

The legal battle hinges on whether NFTs qualify as securities, a debate that remains unresolved. The plaintiffs argue that Nike’s promotion of RTFKT NFTs implied investment potential, violating state consumer laws. Posts on X reflect strong sentiment, with users like @altucard labeling the shutdown a “rug pull” and warning that even major brands face Web3 accountability. If successful, the lawsuit could set a precedent for NFT-related litigation, impacting how companies approach digital assets.

Nike’s broader challenges compound the issue. The company reported $8 billion in inventory and a projected 10-15% revenue drop for Q4 2024, per VnExpress. Its stock has shed 10.3% year-to-date in 2025, hitting a low not seen since 2020. The RTFKT closure aligns with Nike’s struggles to innovate amid competition from brands like Adidas, which has sustained its NFT efforts through partnerships like “Into the Metaverse,” netting $23.5 million.

Nike’s Response and Future Outlook

Nike maintains that RTFKT’s legacy endures through inspired creators and projects, but it has not directly addressed the lawsuit. The company’s earlier NFT ventures, including the .SWOOSH platform on Polygon and the “Our Force 1” collection, faced delays and criticism for limited accessibility, such as the U.S.-only Cryptokicks iRL mint. These missteps may have eroded trust, fueling the current backlash.

The lawsuit’s outcome remains uncertain, but it highlights the risks of corporate ventures into volatile NFT markets. For Nike, navigating this legal storm while addressing declining sales and investor confidence will be critical. The case also underscores the need for clearer regulations around NFTs, as investors demand accountability from brands venturing into Web3.